The platform will offer financial services, such as sales and purchases, investments or exchange opportunities. Forty Seven is a unique project built to create a modern universal bank for both users of cryptocurrencies and adherents of the traditional monetary system; banks to be recognized by international financial organizations; a bank that will comply with all regulatory requirements.

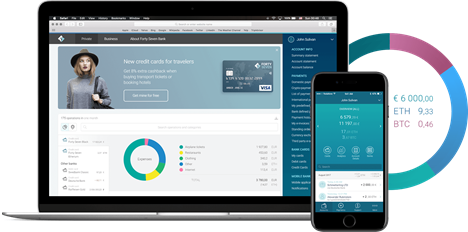

Forty Seven Bank offers its customers a new innovative product called Multi-Asset Account that lets you have access to all bank accounts and crypto wallets using a single account.

MISSION FORTY SEVEN BANK

Forty Seven Bank's mission and management team is to provide safe, innovative and easy-to-use financial services and products to our customers - individuals, businesses, developers, merchants, financial institutions and governments. Forty Seven Bank is a bridge capable of connecting the two financial worlds and building efficient communication between the two, a communication that will open the possibility of improving the modern financial system as a whole.

INNOVATIVE PRODUCTS FORTY SEVEN BANK

Remote identification and authorization based on passport and biometric data

- A unique combination of payment tools - SWIFT cards, credit and debit cards, e-wallet, secure crypto payments.

- Transactions with any type of cryptococcus in the bank application and without the need to wait for the current exchange. Coupon upload, withdrawal and conversion available.

- Various services include crediting, insuring, invoice presentation, credit / debit card management etc.

- Cross platform access for managing client accounts is opened in European banks in accordance with PSD2 orders.

- UI is convenient and user-friendly.

- An analysis that helps the client make the right financial decisions by using a personal manager service created based on the machine learning algorithm.

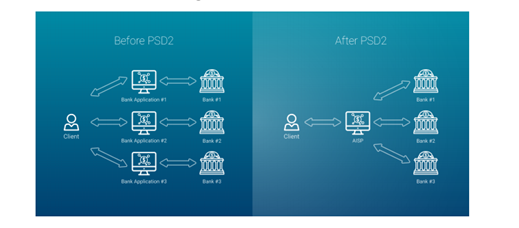

PSD2 opens up various opportunities for the banking industry, especially for

financial technology start up like Forty Seven Bank. Any bank in the EU will do so should adjust its systems and infrastructure to conform to PSD2. For a classic bank with a long history, it is very complex, time consuming and expensive.

PSD2's goal is to increase the digital noise that is changing the future of the banking sector. PSD2 invites new market players to enter a healthy competitive environment to gain market share currently controlled by traditional banks. Today, classical banks have a monopoly on their customer transactions and payment services. PSD2 changed the rules of the game. This enables customers to choose third-party service providers for all their needs, which ensures the security and the most appropriate product due to open market conditions.

PROPOSITION FOR BUSINESS

Business products are oriented towards small and medium enterprises.

- Managing accounts through the Application Programming Interface (API), creating financial applications.

- Receive payment from merchants on both crypto and money in a fiat account (cards, SWIFT) using form or API.

- Bulk payments for the market.

- Loyalty management for clients uses large data.

- Factoring services based on machine learning and large data (artificial intelligent algorithms can predict the probability of repayment of credit and the timeliness of financial assistance to companies).

- Escrow service.

- Mobile app with biometric identification for multi-currency transactions.

Forty Seven Bank TOKEN

With this FBST token users can use to quickly assess their service and product transactions in a single paradigm. On the way to take advantage of some FBST token prospects are the most important building blocks by Forty Seven Bank.

The FBST Token is an influential economic material of tokens in the Forty Seven Bank ecological unit that is entitled to use a variety of desires for their products and services.

- The FSBT Token will be available for transactions on various crypto currency exchanges after the completion of the people's funding campaign.

- Forty Seven Bank products and services were acquired by Etis Dais users.

- The value of one token for a user is .0047 ETH.

In early ICO, crypto in Forty Seven Bank was only accepted in ET as well;

At ICO from Forty Seven Bank, both receive ETTH and BTC.

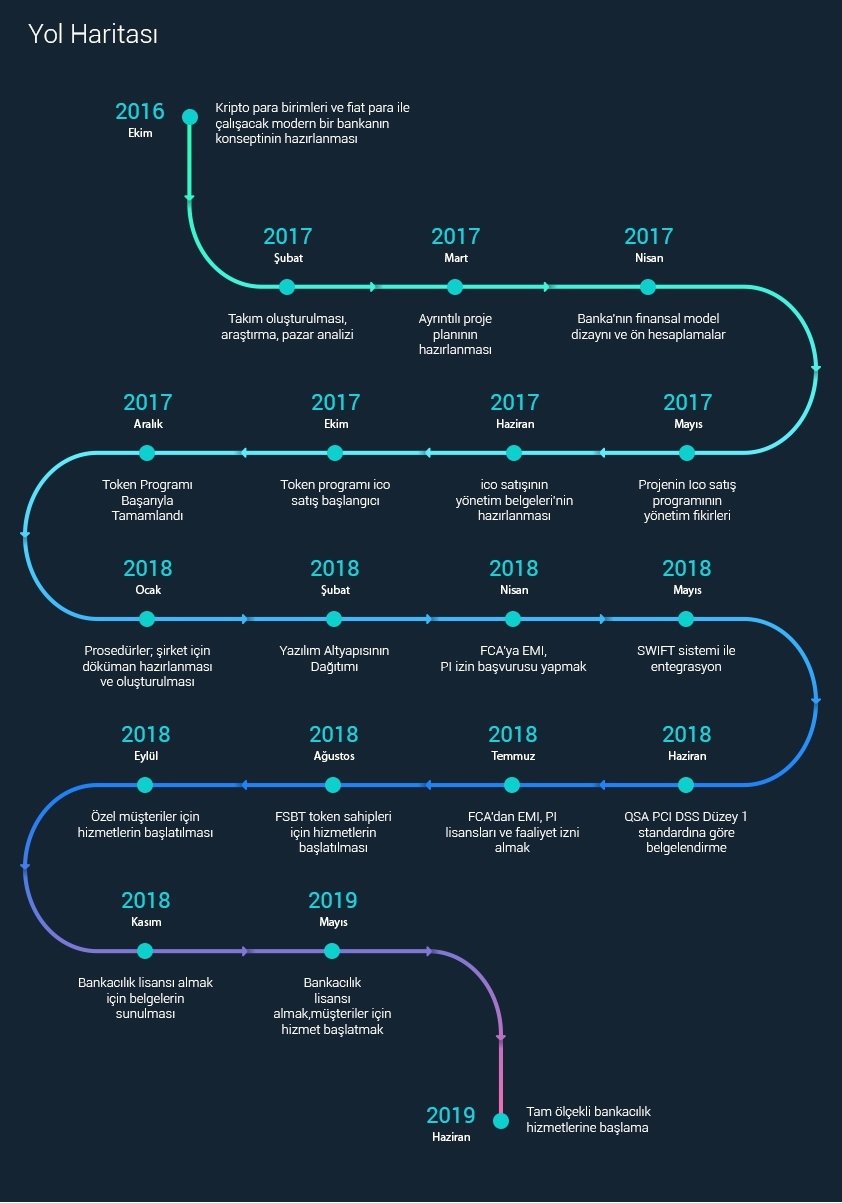

The initial pre-date of ICO 1 was held on the 3rd of October in the 2017 era that London time was at 15:00 GMT. The final date of Forty Seven pre-ICO is on November 6th in the 2017 era that London time is 23:59 GMT. The Forty Seven Bank in Q ICO first began lying in the 2018 era and also lying in Q one of the 2018 era. Top Hard Forty Seven bank devoted to ICO is 360k ETH. Soft close the business of Forty Seven Bank is intended for ETTH 18k. Designed for Pre ICO Hard cover from Forty Seven Bank is 90k ETH.

more info:

Website: https://www.fortyseven.io/

Whitepaper: https://drive.google.com

Telegram: https://t.me/thefortyseven

Facebook: https://www.facebook.com/FortySevenBank/

Twitter: https://twitter.com/47foundation

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=2225492

By RyanEncek

https://bitcointalk.org/index.php?action=profile;u=1076774

ETH: 0xaE5e525E57a6117fa00Ae27b57e94b92B1Bf0c51

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar